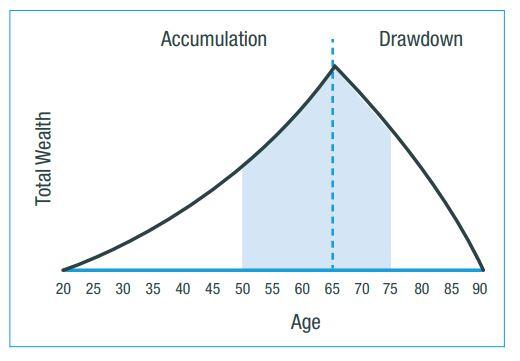

The decisions you make when you are transitioning into retirement can be the most telling for financial security throughout your golden years. Why?

Your accumulated savings pool is likely to be highest in the years nearing retirement – and just after you retire. Investment decisions made at this time can greatly impact your income down the track.

The risk they don’t talk about in the papers

When it comes to investing we are all familiar with the most common definition of risk; investment returns can and will vary. But risk needs to be considered in context of not achieving your objectives – and how a lesser known risk called ‘sequencing risk’ impacts whether or not you meet your goals.

Critical investment period near retirement

Returns matter the most when you have the most capital at risk. Sequencing risk relates to the order in which returns occur.

Rather than just assessing how assets go up or down over a given time horizon, the path of the return also needs to be assessed. This is because your outcome will be a function of both the investment returns achieved and the size of your investment savings. Let me show you with an example.

A poor investment outcome at the wrong time can be very costly

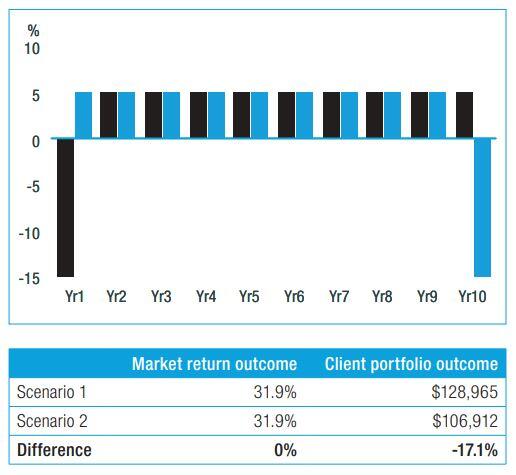

Consider an investor in their accumulation phase who saves $10,000 each year for 10 years. In the below two scenarios, the investor experiences a large negative loss over the course of that decade. In Scenario 1, the investor experiences the loss in the first year, while in Scenario 2, the loss occurs in the final year of their investment.

Both scenarios have the same compounded annualised return and volatility. If you were to read about these returns in the newspaper at the end of the decade, the returns would be the same under either scenario. But the dollar outcomes for the investor are vastly different.

Timing Matters: different outcomes due to different timing of returns

In Scenario 1, the market decline occurred early and impacted savings when the accumulated investment balance was low. In Scenario 2, ten years of savings contributions and years of steady market gains were impacted by the poor returns in the last year.

The difference for the investor who experienced a draw down in the last year was -17.1%. A poor investment outcome at the wrong time can be very costly.

The value of seeking expert advice

Why haven’t you read about sequencing risk more often? Financial markets don’t experience sequencing risk, only investors do. It relates to where you are in your own working/retirement journey and the savings balance you are accumulating ahead of retirement.

Investment strategies are available that aim to improve the outcomes during this important ‘transition to retirement’ phase. These strategies aim to reduce volatility and improve the stability of returns.

This highlights the benefit of seeking expert financial advice to assist with these challenges. Your financial planning adviser can tailor an investment strategy that matches your personal circumstances and seeks to address your multiple objectives. They have required skills and experience to determine if strategies designed for the transition to retirement may be appropriate for you in terms of achieving your long-term financial goals. Top 10 Microgaming Casinos in Australia GunsBet – 100% deposit bonus + 100 free spins. Spin Samurai – 125% match bonus. We recommend these microgaming casino sites to play online. Best Microgaming Casinos For Australians ; 1 · Pokie Spins Casino ; 2. Jackpot Jill Casino ; 3. BitStarz Casino ; 4 · Hell Spin Casino ; 5. National Casino. Play Microgaming casino on PC & mobile software platforms · For AUD players, banking is simple and safe. Microgaming pokies can be found at HellSpin, DundeeSlots, Bizzo and Ricky casino. What is the best Microgaming pokies?

Taking the time to plan your ‘transition to retirement’ can be well worth the effort.

Speak to your Newcastle financial advisors at Leenane Templeton Wealth Management today.

Call (02) 4926 2300 or email us today.

Source: First Sentier